Payment Security Market to Hit $86B by 2032, Driven by Rising Cybersecurity Threat & Widespread Digital Payment Adoption

The Payment Security market expands rapidly, driven by rising cybersecurity threats, growing digital payment adoption, and the need to secure financial data.

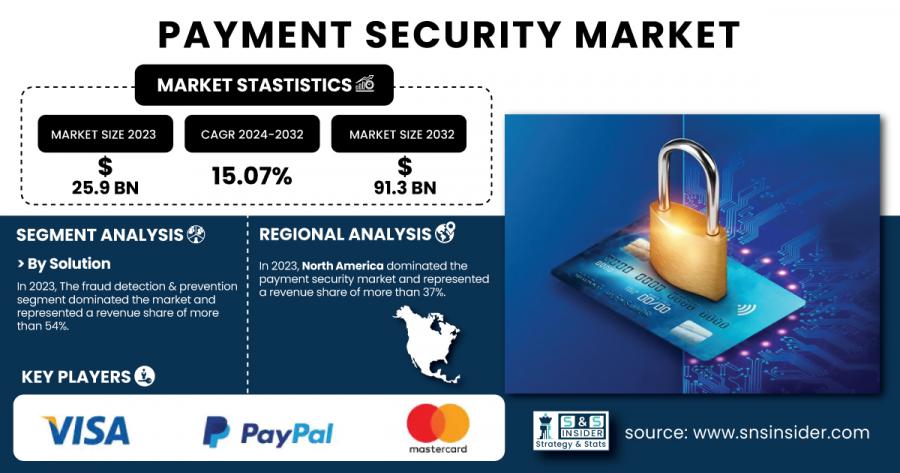

AUSTIN, TX, UNITED STATES, January 10, 2025 /EINPresswire.com/ -- The SNS Insider report indicates that the Payment Security Market size was valued at USD 25.17 billion in 2023 and is expected to grow to USD 86.0 billion by 2032, growing at a CAGR of 14.64% over the forecast period of 2024-2032.

Demand for the payment security market is growing, driven by significant digitalization of payment systems and rising cybercriminal activities. As consumers and businesses alike head towards digital payments – via mobile wallets, online banking, or e-commerce platforms – now we need secure payment solutions like never before. Additionally, the increasing number of mobile commerce as well as contactless payment adoption are other factors propelling the growth of the payment security market. While digital payment systems become more common, digital layers also become opportunities for hackers and fraudsters. Consequently, organizations and financial institutions are now focusing on investing in sophisticated payment security systems like encryption, tokenization, multi-factor authentication, and biometrics tools to safeguard their customers' confidential information and secure transactions.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/4146

Key Players:

The prominent players in the market are Gemalto, Intel Corp., Thales e-Security, Cisco Systems Inc., Symantec Corp., TNS Inc., Trend Micro, CA Inc., HCL Technologies, VASCO Data Security Int. Inc., Broadcom, Inc., RSA Security LLC.

The payment security market is also being driven by governments and regulatory bodies.

With regulations like the Payment Card Industry Data Security Standard and the General Data Protection Regulation having strict requirements for businesses at payment points, stricter security measures have become a necessity. Such data protection regulations protect consumer financial data, and without those mandates, businesses will not comply and trust will not be ensured. Another trend in the market is the growing emphasis on AI and ML technologies in payment security solutions. AI and ML are helping to find and prevent fraud in real-time by analyzing transaction data and identifying suspicious behavior. Especially now, with the growth of digital transactions.

Wide use of mobile wallets and e-commerce platforms in growth regions such as Asia-Pacific, Latin America, and the Middle East enlarges the need for secure and efficient payment solutions. With consumers in these markets using digital payments for everyday transactions more than ever before, the availability of secure and reliable payment systems cannot come fast enough.

Segmentation Analysis

By Platform

In 2023, the POS-based/mobile-based segment led the market with a significant revenue share. Mobile-based payment systems, usually integrated with various point of sale systems are common in retail, hospitality, healthcare, transportation, and other industries. The systems allow merchants and consumers to make their payments quickly and securely through mobile devices, tablets, and POS terminals. Security threats. POS-based/mobile-based payment systems are vulnerable to plenty of security threats such as card skimming, data breaches, malware attacks, and social engineering scams. Consequently, the technology for payment security has advanced; solutions providers like those offering encryption, tokenization, fraud detection, or multi-factor authentication now offer various methods of protection over such systems and payment transactions.

The web-based segment is expected to grow at a significant CAGR during the forecast period. This growth in the segment is driven by the rising adoption of online payments and e-commerce. An online payment system allows consumers to do PHHS and other transactions to pay online with their desktop or mobile device without putting anything in the store or designated payment terminal. Such comfort has propelled online exchanges widely and web-based payment arrangements have turned into the core of the whole payment biological system.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/4146

Regional Landscape

In 2023, North America held the highest revenue share in the payment security market. With the presence of global payment security providers, like Visa Inc., U.S. Bancorp, Mastercard, &Shift4, North America is a key market for payment security.. The North American regional market growth is also being accelerated witnessing the trend towards digital payment for payment at malls/restaurants and the availability of wider opportunities for the vendors and providers in the region.

Asia Pacific is expected to be the fastest-growing market during the forecast period. The growth of this region is primarily attributed to the rising regulatory requirements and compliance standards regarding payment security. The growth of the Asia Pacific market is maintained by the ride of strict regulations and guidelines for payment security such as in China, India, and Japan.

Recent Developments

March 2024: PayPal unveiled a new multi-factor authentication system to enhance the security of its digital wallet services. The system combines traditional passwords with biometric authentication and one-time passcodes to ensure secure transactions.

Access Full Report: https://www.snsinsider.com/reports/payment-security-software-market-4146

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release