Acrylonitrile Butadiene Styrene Market USD 56.4 Bn By 2034, Virgin ABS Segment (84.3% Share )

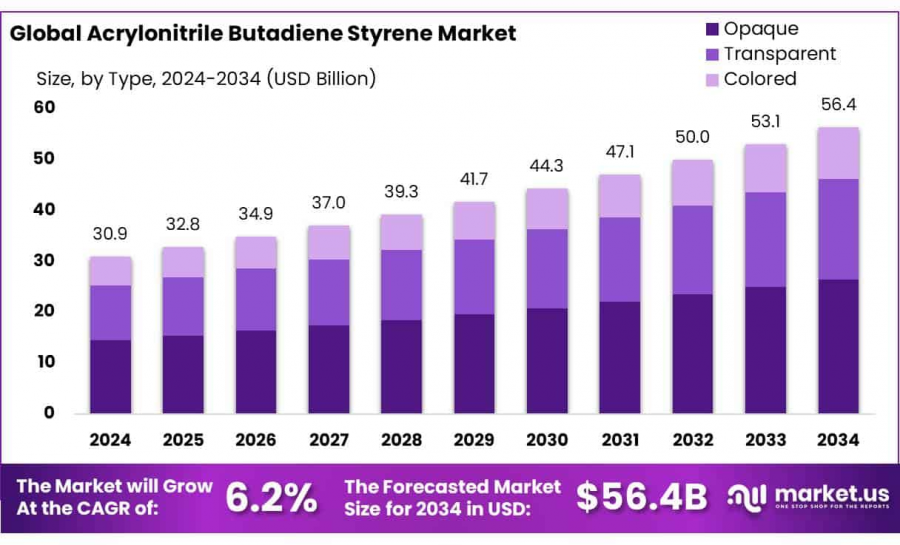

Acrylonitrile Butadiene Styrene Market size is expected to be worth around USD 56.4 Bn by 2034, from USD 30.9 Bn in 2025, at a CAGR of 6.2% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global Acrylonitrile Butadiene Styrene (ABS) Market is integral to numerous industries, including automotive, consumer goods, and electronics, due to its superior properties such as high impact strength, rigidity, and gloss. Acrylonitrile Butadiene Styrene, a thermoplastic polymer, is renowned for its ease of processing and versatility in applications ranging from injection molding to extrusion processes.

Several factors contribute to the burgeoning demand for Acrylonitrile Butadiene Styrene. Economic growth in emerging markets has led to increased consumer spending on automobiles and electronic goods, thereby boosting the demand for Acrylonitrile Butadiene Styrene. Urbanization trends have also played a significant role, as more people moving to urban areas increase the consumption of products made with Acrylonitrile Butadiene Styrene. Furthermore, the global shift towards lightweight materials in the automotive industry to improve fuel efficiency and reduce emissions has heightened the demand for Acrylonitrile Butadiene Styrene, which is lighter compared to traditional materials like metal.

Demand for Acrylonitrile Butadiene Styrene is also influenced by the shifting trends toward high-performance plastics. Industries are increasingly replacing metals and other heavier plastics with Acrylonitrile Butadiene Styrene due to its cost-effectiveness, lightweight nature, and superior physical properties. The consumer goods sector also reflects a growing preference for Acrylonitrile Butadiene Styrene in appliances and toys due to its safety, durability, and aesthetic appeal. However, volatility in raw material prices and the push for environmental sustainability pose challenges to the Acrylonitrile Butadiene Styrene market, influencing manufacturers to innovate and adapt.

Technological advancements in the production and application of Acrylonitrile Butadiene Styrene have significantly impacted the market. Innovations in additive manufacturing, particularly 3D printing, have opened new avenues for the use of Acrylonitrile Butadiene Styrene. 3D printing with Acrylonitrile Butadiene Styrene allows for the creation of complex and customized designs, which are particularly beneficial in prototype development and small-scale manufacturing across industries. Additionally, advancements in alloy and blend techniques have enhanced the properties of Acrylonitrile Butadiene Styrene, making it more resistant to impacts, heat, and chemicals, thereby broadening its applicational scope.

The rising trend of electric vehicles (EVs) and the ongoing innovation in electronics are expected to drive further demand for Acrylonitrile Butadiene Styrene. The EV market, with its need for lightweight, high-performance materials for both interior and exterior applications, provides a robust platform for the growth of Acrylonitrile Butadiene Styrene. Similarly, the electronics industry's continuous evolution demands innovative materials that meet the requirements of new device designs and functionalities, keeping the demand for Acrylonitrile Butadiene Styrene strong.

To learn more about the findings of this research, please check: https://market.us/report/acrylonitrile-butadiene-styrene-market/free-sample/

Key Takeaways

⦿ Acrylonitrile Butadiene Styrene Market size is expected to be worth around USD 56.4 billion by 2034, from USD 30.9 billion in 2025, growing at a CAGR of 6.2%

⦿ The opaque segment of the Acrylonitrile Butadiene Styrene (ABS) market held a dominant position, capturing more than a 46.7% share.

⦿ Virgin held a dominant market position, capturing more than a 84.3% share.

⦿ Emulsion Polymerization held a dominant market position, capturing more than a 56.40% share.

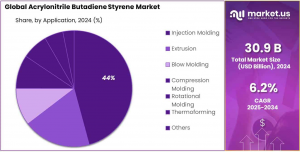

⦿ Injection Molding held a dominant market position, capturing more than a 43.30% share.

⦿ The appliance segment held a dominant market position in the Acrylonitrile Butadiene Styrene (ABS) market, capturing more than a 27.3% share.

Acrylonitrile Butadiene Styrene Top Trends

Increasing Demand in the Automotive Sector: The automotive industry is progressively utilizing ABS due to its lightweight and durable properties, which contribute to improved fuel efficiency and reduced emissions. ABS is commonly used in manufacturing automotive components such as dashboards, bumpers, and interior trims, aligning with the industry's focus on sustainability and performance.

Growth in the Electronics and Electrical Industry: The rise in consumer electronics has led to a higher demand for ABS, favored for its excellent electrical insulation and moldability. Manufacturers prefer ABS for producing housings and components of devices like televisions, computers, and smartphones, owing to its strength and aesthetic finish.

Advancements in Sustainable and Recycled ABS: Environmental concerns are driving the development of eco-friendly ABS variants. Companies are investing in research to produce bio-based and recyclable ABS materials, aiming to reduce the environmental footprint and comply with stringent regulations, thereby appealing to environmentally conscious consumers.

Expansion in the Construction Industry: ABS is gaining traction in the construction sector for applications such as pipes, fittings, and other building materials due to its robustness and resistance to impact and chemicals. The material's adaptability to various construction needs supports the industry's demand for reliable and long-lasting materials.

Technological Innovations in Production Processes: The ABS industry is witnessing technological advancements aimed at enhancing production efficiency and product quality. Innovations include improved polymerization techniques and the integration of automation in manufacturing processes, leading to cost reductions and higher consistency in product performance.

Key Market Segments

By Type Analysis

In 2024, the Opaque segment dominated the Acrylonitrile Butadiene Styrene (ABS) market, capturing over 46.7% market share. This segment benefits from its extensive application in industries requiring high durability, chemical resistance, and impact strength. The automotive and electronics sectors heavily utilize opaque ABS for components like dashboards, enclosures, and structural parts, where both aesthetic and functional opacity are crucial. Its superior performance characteristics make it a preferred choice for manufacturers across multiple industries.

The Transparent ABS segment, although smaller in share, is valued for its clarity and strength, making it ideal for applications that require both visual appeal and robustness. Commonly used in protective covers, machine parts, and medical devices, this type offers glass-like transparency while maintaining superior impact resistance at a lower cost. Its increasing adoption in industries requiring high-strength transparent materials is expected to drive steady growth.

By Source Analysis

In 2024, Virgin ABS held a dominant position in the market, capturing over 84.3% share. This segment benefits from its high purity, superior mechanical properties, and ease of processing, making it ideal for high-precision applications in the automotive, electronics, and consumer goods industries. Manufacturers prefer virgin ABS for its consistency, durability, and ability to meet stringent quality standards, ensuring reliability in performance-critical applications.

Recycled ABS, though holding a smaller share, is witnessing growing adoption due to rising environmental concerns and the push for sustainable manufacturing. This segment provides an eco-friendly alternative by reducing plastic waste and conserving resources, making it ideal for non-load-bearing components and cost-sensitive applications. As recycling technologies advance and regulatory frameworks favor sustainability, the demand for recycled ABS is expected to grow steadily.

By Production Method Analysis

In 2024, Emulsion Polymerization led the ABS production market, accounting for more than 56.40% share. This method is widely preferred due to its ability to produce ABS with enhanced toughness and impact resistance, making it ideal for automotive parts and consumer electronics. Emulsion polymerization allows for fine particle distribution, ensuring superior product performance across diverse applications. The steady increase in ABS demand across industries has driven the adoption of this production technique.

Mass Polymerization also maintained a significant market position, contributing substantially to global ABS production. This method, known for its high purity and excellent finish, is widely used in applications that require aesthetic appeal and superior material consistency, such as household appliances and medical devices. The demand for specialized ABS grades that offer easy processing and premium quality continues to support the growth of this segment.

By Application Analysis

In 2024, Injection Molding emerged as the leading application segment, accounting for over 43.30% of the ABS market. Widely used for manufacturing complex and precision-based components, this technique remains cost-effective and highly efficient, making it a preferred choice in automotive, electronics, and consumer goods. The growing emphasis on lightweight and durable components, combined with advancements in molding technology, has further strengthened the dominance of this segment.

Extrusion held a substantial market share, driven by its versatility in producing pipes, profiles, and sheets. This process is widely used in the construction and consumer goods industries due to its high-speed production capabilities and cost efficiency. The increasing demand for rigid, weather-resistant materials has propelled the growth of extrusion applications in the ABS market.

Key Market Segments List

Type

- Opaque

- Transparent

- Colored

By Source

- Virgin

- Recycled

Production Method

- Emulsion Polymerization

- Mass Polymerization

- Suspension Polymerization

Application

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Rotational Molding

- Thermoforming

- Others

End-use

- Appliances

- Electrical and Electronics

- Automotive

- Consumer Goods

- Construction

- Others

Regulations On the Acrylonitrile Butadiene Styrene Market

⦾ Environmental Regulations and Sustainability Compliance

European Union (EU) Regulations: The Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) Regulation (EC 1907/2006) governs the use of ABS in Europe, ensuring that its chemical components meet strict safety standards. The EU Circular Economy Action Plan also encourages the development of recyclable ABS formulations, pushing manufacturers toward sustainable production practices.

United States Regulations: The Environmental Protection Agency (EPA) enforces laws under the Toxic Substances Control Act (TSCA), which requires manufacturers to evaluate environmental and human health risks of ABS production. Additionally, the Occupational Safety and Health Administration (OSHA) regulates workplace safety measures concerning the handling of ABS materials.

China’s Environmental Policies: China, one of the largest producers of ABS, has implemented stricter plastic waste management policies through the Plastic Restriction Order, which mandates increased recycling and sustainable production methods. The National Development and Reform Commission (NDRC) also enforces pollution control policies impacting the ABS market.

⦾ Restrictions on Hazardous Substances

RoHS Directive (Restriction of Hazardous Substances, EU 2011/65/EU): Regulates the use of lead, cadmium, mercury, and other toxic substances in electrical and electronic equipment. ABS manufacturers supplying components to electronics and automotive industries must comply with RoHS standards to limit hazardous material exposure.

FDA and EU Food Contact Regulations: ABS used in food packaging and beverage containers must comply with the Food and Drug Administration (FDA) 21 CFR regulations in the U.S. and the European Food Safety Authority (EFSA) guidelines in Europe to ensure chemical safety and non-toxicity.

California Proposition 65 (Safe Drinking Water and Toxic Enforcement Act): Mandates warnings on products containing chemicals linked to cancer or reproductive harm. ABS manufacturers supplying goods to California markets must ensure compliance to avoid legal repercussions.

⦾ Emission and Recycling Policies

Carbon Emission Regulations: The ABS industry is subject to cap-and-trade policies and carbon taxes in regions such as the European Union (EU ETS) and China’s National Emission Trading Scheme, encouraging manufacturers to reduce greenhouse gas (GHG) emissions from production facilities.

ISO Standards for Sustainable Plastics: The International Organization for Standardization (ISO) has established standards such as ISO 14001 (Environmental Management Systems) and ISO 17422 (Environmental Aspects of ABS Materials), guiding manufacturers toward sustainable production and responsible disposal practices.

⦾ Regulatory Challenges and Industry Adaptation

Compliance Costs: Stricter environmental regulations and material restrictions increase production costs, driving companies to invest in eco-friendly alternatives, bio-based ABS, and advanced recycling technologies.

Innovation in Sustainable ABS: Companies are exploring biodegradable and recycled ABS materials to meet regulatory requirements while maintaining product performance and durability.

Global Trade Regulations: ABS producers must navigate import/export restrictions and tariffs, particularly in key markets such as the U.S., Europe, and China, where trade policies significantly impact supply chain operations.

Buy The Complete Report to read the analyzed strategies Get Discounts of Up to 30%! https://market.us/purchase-report/?report_id=123778

Regional Analysis

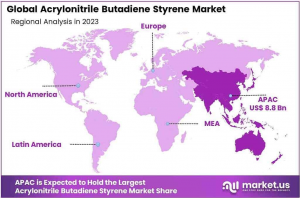

Asia Pacific holds a commanding share of approximately 34.2%, with a market valuation of USD 10.5 billion in 2024. The region's dominance is driven by rapid industrialization and urbanization, particularly in China and India, where growing infrastructure projects and manufacturing expansions fuel ABS demand. The automotive, electronics, and construction sectors are major consumers of ABS, supported by government policies promoting industrial growth. With increasing foreign investments and local production capabilities, Asia Pacific continues to strengthen its leadership in the global ABS market.

North America follows as a key player in the ABS market, backed by technological advancements and stringent regulatory standards. The region experiences high demand for ABS in automotive applications, particularly in the United States and Canada, where major manufacturers integrate ABS in lightweight and durable vehicle components. Additionally, North America benefits from rising applications in electronics and consumer goods, further driving market growth. The combination of innovation, strong industrial presence, and regulatory compliance makes North America a stable and expanding ABS market.

Europe maintains a stable position in the ABS market, primarily supported by a well-established automotive sector and increasing applications in electronics and consumer products. Countries such as Germany and France lead the regional market, leveraging ABS for its high-impact resistance and design versatility. The shift towards sustainable materials and growing emphasis on energy-efficient automotive components contribute to the consistent demand for ABS across European industries.

Key Players Analysis

- CHIMEI

- LG Chem

- Asahi Kasei Corporation

- SABIC

- BASF SE

- Formosa Plastics

- INEOS

- PetroChina

- Toray Industries, Inc.

- KUMHO PETROCHEMICAL

- LOTTE Chemical Corporation

- Covestro AG

- Trinseo

- Versalis S.p.A.

- RTP Company, Inc.

- Other Key Players

Conclusion

In conclusion, the global Acrylonitrile Butadiene Styrene market for is on a positive trajectory, supported by its critical role in multiple industries and enhanced by technological advancements. As industries continue to demand more versatile and high-performance materials, ABS stands out as a key player. With strategic focus on innovation, particularly in sustainability and advanced material properties, the ABS market is set to grow and evolve, meeting the challenges and capturing the opportunities of the changing industrial landscape.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release