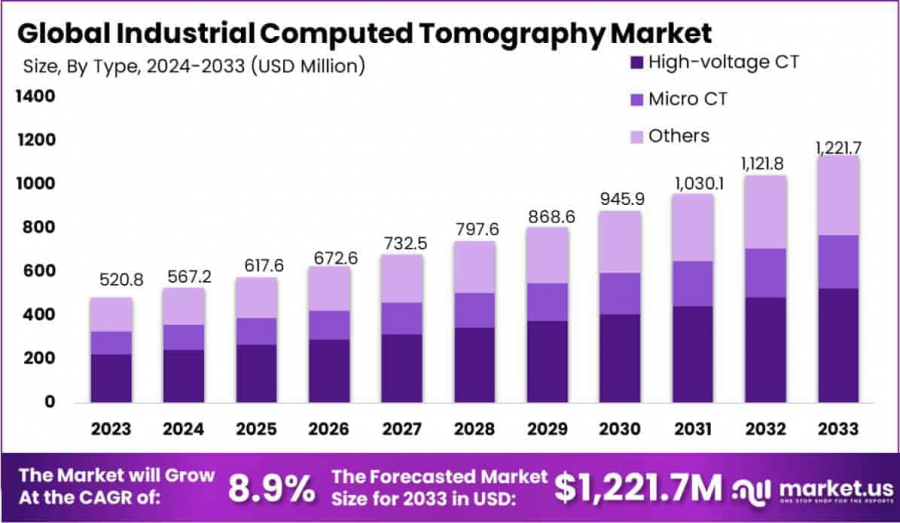

Industrial Computed Tomography Market Hit USD 1,221.7 Million by 2033, Expanding at a CAGR of 8.9%

Industrial Computed Tomography Market is projected to reach USD 1,221.7 million by 2033, growing at an 8.9% CAGR from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- **Report Overview**

The Global Industrial Computed Tomography Market is projected to reach approximately USD 1,221.7 Million by 2033, up from USD 520.8 Million in 2023, with a compound annual growth rate (CAGR) of 8.9% from 2024 to 2033.

Industrial Computed Tomography (CT) is a non-destructive imaging technology that employs X-ray beams to create detailed, high-resolution 3D images of objects and materials. This advanced diagnostic tool allows for the inspection of internal structures without causing damage to the tested materials. By using CT, manufacturers and engineers can evaluate complex geometries, detect defects, and ensure product quality, which is crucial in industries such as aerospace, automotive, and electronics.

The Industrial Computed Tomography market refers to the commercialization and widespread adoption of this technology across various sectors. It is driven by the increasing demand for precise, high-quality inspection processes that minimize production downtime and reduce the costs associated with faulty products. As industries continue to embrace automation and precision manufacturing, the adoption of industrial CT is becoming more integral to quality control and research and development.

Several growth factors are fueling the market's expansion. Increasing focus on product quality and safety standards, coupled with the demand for reducing human error in inspections, is prompting industries to adopt advanced imaging techniques like CT. Additionally, the rise of automation and Industry 4.0 technologies, which emphasize smart manufacturing solutions, is accelerating the integration of CT into production processes.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/industrial-computed-tomography-market/request-sample/

The demand for industrial CT is being further driven by the need for faster and more accurate inspections in industries where precision is paramount. As the technology becomes more affordable and accessible, opportunities are emerging for small and medium-sized enterprises (SMEs) to leverage CT for quality assurance. Furthermore, emerging applications in additive manufacturing and materials science present untapped potential for the growth of this market.

**Key Takeaways**

~~ The Global Industrial Computed Tomography Market is projected to reach USD 1,221.7 million by 2033, growing from USD 520.8 million in 2023, at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2033.

~~ By Offering Segment: Equipment led the market, capturing 52.1% of the share.

~~ By Type Segment: High-voltage CT held the dominant position, accounting for 43.1% of the share.

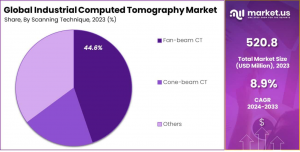

~~ By Scanning Technique Segment: Fan-beam CT maintained the leading market share, representing 44.6%.

~~ By Application Segment: Flaw Detection and Inspection dominated with a 25.4% share.

~~ By Vertical Segment: The Automotive industry held the largest share, with 27.2% of the market.

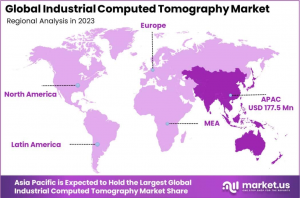

~~ In 2023, the Asia Pacific region was the market leader, holding 34.1% of the total market share and generating USD 177.5 million in revenue.

**Regional Analysis**

Asia Pacific Leads the Industrial Computed Tomography Market with the Largest Market Share of 34.1% in 2023

The Industrial Computed Tomography (CT) market is experiencing growth across various regions, with Asia Pacific holding the dominant share of the market. In 2023, the Asia Pacific region accounted for 34.1% of the global market, valued at approximately USD 177.5 million. This region’s stronghold can be attributed to the rapid industrialization, the increasing adoption of advanced manufacturing technologies, and the rising demand for non-destructive testing solutions in key industries like automotive, aerospace, and electronics.

North America follows closely, driven by robust technological advancements, strong industrial base, and widespread implementation of industrial CT solutions in various sectors, including healthcare, automotive, and oil & gas. Europe also showcases substantial growth, led by strong industrial and technological infrastructure, with notable growth in the automotive and manufacturing sectors.

The Middle East & Africa, though a smaller market, is expected to grow steadily due to increasing investments in infrastructure and manufacturing capabilities. Meanwhile, Latin America is witnessing gradual adoption of industrial CT, fueled by growing demand in sectors such as automotive and energy

**Market Segmentation**

In 2023, the Equipment segment dominated the Industrial Computed Tomography Market, holding a 52.1% share. This segment includes hardware and integrated systems essential for CT technology in industrial applications. The strong demand for high-resolution imaging in sectors like aerospace, automotive, and electronics drives this growth. The Services segment, while smaller, is growing in importance as industries seek comprehensive solutions that ensure continuous operational efficiency. Services such as installation, maintenance, and software support enhance the performance and lifespan of CT equipment. The synergy between equipment and services is expected to drive further growth and adoption in the market.

In 2023, the Industrial Computed Tomography (CT) Market was dominated by High-voltage CT, which held a 43.1% market share due to its ability to inspect dense materials with high X-ray power, making it ideal for aerospace, automotive, and heavy machinery industries. Micro CT, used for high-resolution imaging of small objects, is crucial in electronics, material science, and biomedical research. The “Others” category includes specialized CT systems designed for niche industrial applications, offering customized solutions for various materials and component sizes. These segments reflect the market’s technological diversity, addressing specific industry needs through tailored solutions.

In 2023, Fan-beam CT dominated the "By Scanning Technique" segment of the Industrial Computed Tomography Market, holding a 44.6% share, due to its ability to deliver high-speed scanning and high-resolution images, particularly in automotive and aerospace industries for defect detection. Cone-beam CT, capturing the second-largest share, is preferred for applications requiring 3D image reconstruction, such as in dental and small bone orthopedics, as well as some industrial non-destructive testing. The "Others" category includes specialized scanning techniques designed for specific applications where Fan-beam and Cone-beam CTs may not be optimal, highlighting the market's diverse solutions to meet varied industrial needs.

In 2023, the Industrial Computed Tomography (CT) Market was dominated by the Flaw Detection and Inspection application, which held a 25.4% market share. This application is vital in industries like aerospace, automotive, and heavy engineering for ensuring component integrity by identifying internal and external imperfections. Following closely is Failure Analysis, which provides valuable insights for preventing future risks and improving product designs. Other significant applications include Assembly Analysis and Dimensioning and Tolerancing Analysis, crucial for ensuring accuracy and quality in manufacturing processes. The "Others" category reflects the technology's adaptability, catering to niche, customized needs across various industries, highlighting the versatility of industrial CT.

In 2023, the Automotive sector led the Industrial Computed Tomography (CT) market with a 27.2% share, driven by its need for precision in component manufacturing and quality assurance. Aerospace and Defense, Electronics, and Oil & Gas sectors also play significant roles, utilizing CT for detailed inspections of critical parts and systems, such as engine components, micro-electronics, and geological samples. Each industry’s unique demands for safety, quality, and performance standards fuel the continued adoption and advancement of industrial CT technology, contributing to ongoing market growth.

**Key Market Segments**

By Offering

~~ Equipment

~~ Services

By Type

~~ High-voltage CT

~~ Micro CT

~~ Others

By Scanning Technique

~~ Fan-beam CT

~~ Cone-beam CT

~~ Others

By Application

~~ Flaw Detection and Inspection

~~ Failure Analysis

~~ Assembly Analysis

~~ Dimensioning and Tolerancing Analysis

~~ Others

By Vertical

~~ Oil & Gas

~~ Aerospace and Defense

~~ Automotive

~~ Electronics

~~ Others

**Driving factors**

Advancements in Industrial CT Technology

Advancements in industrial computed tomography (CT) technology are driving the growth of the global market. The continuous development of higher-resolution imaging systems, coupled with the integration of automation and artificial intelligence (AI), is significantly improving the efficiency and accuracy of industrial inspections. These innovations allow for faster scanning times, enhanced defect detection, and the ability to analyze complex materials in greater detail. As industries like aerospace, automotive, and manufacturing demand precise, non-destructive testing for quality control, these technological breakthroughs are fueling market expansion and elevating the adoption of industrial CT across various sectors.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=13665

**Restraining Factors**

High Initial Investment and Maintenance Costs

The high initial investment and ongoing maintenance costs associated with industrial CT systems pose a significant restraint to market growth. These advanced machines require substantial capital expenditures, which can be prohibitive for small and medium-sized enterprises (SMEs). Additionally, the need for specialized personnel to operate the systems and the expenses related to regular maintenance and calibration further contribute to the overall cost burden. This financial barrier slows the widespread adoption of industrial CT, limiting its potential growth in certain regions and industries.

**Growth Opportunity**

Growing Demand for Non-Destructive Testing

The rising demand for non-destructive testing (NDT) methods presents a substantial opportunity for the industrial computed tomography market. Industries such as automotive, aerospace, and electronics are increasingly adopting NDT techniques to ensure product integrity and safety without causing damage. Industrial CT provides precise, 3D imaging that enables the detection of internal defects, voids, or material inconsistencies, making it an attractive solution for quality control. As regulatory standards around safety and quality tighten, the market for non-destructive testing is expected to expand, driving further growth for industrial CT systems.

**Latest Trends**

Integration of AI and Automation in CT Systems

The integration of artificial intelligence (AI) and automation is a key trend reshaping the industrial CT market. AI-driven software is enhancing image analysis capabilities, enabling faster and more accurate defect detection and reporting. Automation in scanning processes is improving throughput and reducing the need for manual intervention. These technological advancements streamline the inspection workflow, increase productivity, and ensure higher consistency in results. As industries seek greater efficiency and reliability, the adoption of AI and automation in industrial CT systems is expected to accelerate, further bolstering market growth.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In the Global Industrial Computed Tomography (CT) Market, key players such as GE Measurement & Control Solutions, Siemens AG, and Nikon Metrology dominate the competitive landscape due to their advanced technologies and strong market presence. GE and Siemens offer innovative CT systems with a focus on high precision and reliability, driving adoption across industries such as automotive, aerospace, and manufacturing. ZEISS Group and YXLON International further strengthen the market with their cutting-edge inspection and imaging solutions, while North Star Imaging is known for its user-friendly yet highly accurate equipment.

Rigaku Corporation and Carl Zeiss Industrial Metrology bring strong contributions to material testing and analysis through their industrial CT scanners, meeting the rising demand for non-destructive testing. Other notable players, such as Shimadzu Corporation, Werth Messtechnik, 3D Systems, and Avonix Imaging, add value through diverse product offerings and global reach, contributing to a highly fragmented but rapidly expanding market. The market's growth is expected to be fueled by continued technological advancements and growing demand for quality control and defect detection solutions across various industrial sectors.

Top Key Players in the Market

~~ GE Measurement & Control Solutions

~~ Siemens AG

~~ Nikon Metrology

~~ ZEISS Group

~~ YXLON International

~~ North Star Imaging

~~ Rigaku Corporation

~~ Carl Zeiss Industrial Metrology

~~ Shimadzu Corporation

~~ Werth Messtechnik

~~ 3D Systems

~~ Avonix Imaging

~~ Other Key Players

**Recent Developments**

~~ In May 2024, North Star Imaging secured $20 million in funding to develop advanced CT imaging solutions for the aerospace industry.

~~ In March 2024, YXLON International acquired a smaller competitor to expand its market reach and enhance its low-energy CT systems for the electronics sector.

~~ In January 2024, ZEISS Group launched a new CT scanner model for high-throughput industrial metrology, increasing scan speed by 30% to boost productivity in manufacturing.

**Conclusion**

The Global Industrial Computed Tomography (CT) Market is experiencing significant growth, projected to reach USD 1,221.7 million by 2033, from USD 520.8 million in 2023, with a CAGR of 8.9%. The increasing demand for high-precision, non-destructive testing across industries such as automotive, aerospace, and electronics is driving adoption, particularly with advancements in technology like AI and automation. While the market faces challenges due to high initial investment and maintenance costs, the rising need for non-destructive testing and improved imaging capabilities presents substantial growth opportunities. Key players such as GE, Siemens, and Nikon Metrology are leading the way, positioning the market for continued expansion.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Manufacturing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release