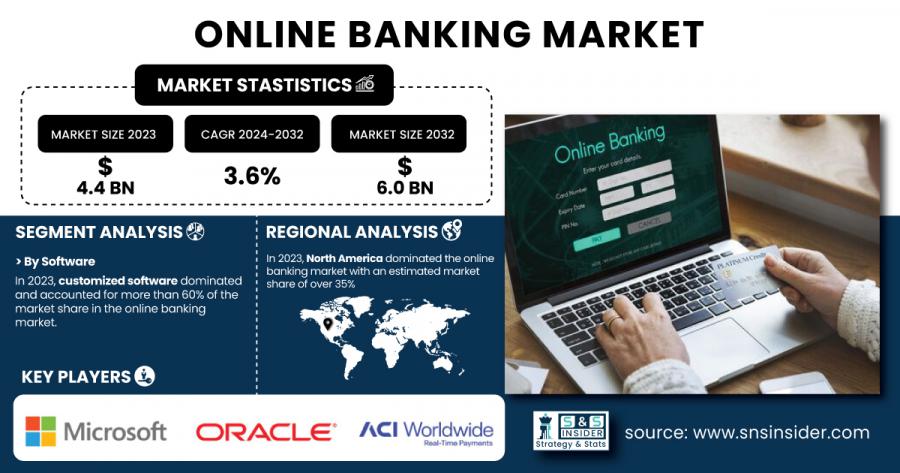

Online Banking Market to Surpass USD 6.0 Billion by 2032 Driven by Tech Advancements & Customer Demand

The Online Banking Market was valued at USD 4.4 Bn in 2023 and is projected to reach USD 6.0 Bn by 2032, growing at a CAGR of 3.6% from 2024 to 2032.

AUSTIN, TX, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- The Online Banking Market size was USD 4.4 Billion in 2023 and is expected to reach USD 6.0 Billion by 2032 and grow at a CAGR of 3.6% over the forecast period of 2024-2032.

The Online Banking Market is growing rapidly as consumers and businesses embrace digital solutions for managing finances.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/1233

Some of Major Keyplayers:

- ACI Worldwide (Universal Payments, ACI Enterprise Payments, ACI UP Retail Payments)

- Alkami Technology, Inc. (Digital Banking Platform, Alkami Fraud Protection)

- Backbase (Engagement Banking Platform, Digital Sales, Digital Banking Platform)

- Cor Financial Solutions Ltd. (Salerio, Paragon)

- EdgeVerve Systems Limited (Finacle Core Banking, Finacle Digital Engagement Suite)

- Fiserv, Inc. (DNA, DigitalAccess, Enterprise Payments Platform)

- Finastra (Fusion Digital Banking, Fusion Payments, Fusion Essence)

- FIS (Fidelity National Information Services) (Clear2Pay, FIS Digital One, FIS Core Banking)

- Infosys Ltd. (Finacle Core Banking, Infosys Digital Banking Suite)

- Intellect Design Arena Ltd. (iGCB - Global Consumer Banking, Intellect Digital Core)

- Jack Henry & Associates, Inc. (Symitar, Banno Digital Platform, SilverLake System)

- Microsoft Corporation (Dynamics 365 Banking Accelerator, Azure Cloud for Financial Services)

- NCR Corporation (Digital Banking Platform, NCR Channel Services)

- Oracle Corporation (Oracle FLEXCUBE, Oracle Banking Digital Experience)

- Q2 Holdings, Inc. (Q2 Digital Banking Platform, Q2 Open, Q2 Catalyst)

- Rockall Technologies (Collateral Management System, Loan Management Solutions)

- SAP SE (SAP S/4HANA for Financial Products Subledger, SAP Fioneer)

- Tata Consultancy Services (TCS BaNCS, TCS Financial Solutions)

- Temenos Group AG (Temenos Transact, Temenos Infinity, Temenos Payments)

- VSoft Corporation (CoreSoft, OnView, Wings)

Evolving Landscape of Online Banking: Innovation and Security

The online banking market is rapidly evolving due to digital platforms, smartphone adoption, and AI and blockchain integration. These technologies advance security, improve the customer experience, and expedite transactions, especially those across borders. Fintech and banks collaborate to introduce AI-powered instruments and systems for fraud detection, creating personalized banking services. Growth-driven innovations apart, from phishing and data breaches are a challenge that needs to be addressed through robust cybersecurity measures by financial institutions. They are investing in multi-factor authentication, encryption, and AI-based fraud detection for improving safety, hence online banking also being safe and more accessible.

Segment Analysis

By Software

In 2023, the customized Software segment dominated the online banking market, accounting for more than 60% of the market share. This is because of the increasing need for customized solutions that can be used by banks and their customers to fulfill their unique needs. Customized software provides financial institutions with the opportunity to integrate features such as AI-based fraud detection, personalized finance recommendations, and seamless cross-platform compatibility. This flexibility allows banks to provide more intuitive, secure, and scalable solutions that meet the specific demands of their customer base, making customized software a preferred choice over off-the-shelf alternatives.

By Service Type

The Payments segment emerged as the dominant force in the online banking market in 2023, with a revenue share of approximately 40%. The growth of this segment has been fueled by the increasing popularity of e-commerce, mobile wallets, and digital payment services. As consumers increasingly opt for digital payments over traditional in-branch transactions, banks have focused on deploying real-time payment applications such as Zelle and PayPal, offering an alternative to conventional banking. This shift towards seamless and instant digital payments has been one of the key factors driving the evolution of the online banking ecosystem.

By Software

- Customized software

- Standard software

By Service Type

- Payments

- Processing Services

- Customer & Channel Management

- Wealth Management

- Others

By Type

- Informational services

- Transactional services

- Communicative services

By Banking Type

- Retail Banking

- Corporate Banking

- Investment Banking

Enquiry Before Buy this Report: https://www.snsinsider.com/enquiry/1233

North America Dominates Online Banking Market, While Asia-Pacific Sees Rapid Growth in 2023

In 2023, North America led the global online banking market, holding an estimated market share of over 35%. This dominance is based on the region's powerful digital infrastructure, high internet penetration, and wide adoption of mobile banking services. Global banking giants such as JPMorgan Chase, Bank of America, and Citibank have also invested heavily in digital banking platforms, available services include easy web-based payments through the Internet, mobile banking applications, and AI-based financial management services.

The Asia-Pacific region emerged as the fastest-growing market in 2023, with an estimated CAGR of over 15%. The use of a smartphone and the Internet in places like China, India, and Southeast Asia reflects the sudden explosion of online banking in those regions. The middle-class demographic also comes to mind; an increased demand for financial inclusion in rural areas contributed to the growth of digital-first banking solutions. India's Digital India program also pushed for this digital banking change in the region.".

Recent Developments

- In July 2024, GAM Holding AG announced the sale of its management company to Apex Group. This move was part of GAM's strategy to focus on its core asset management business, while Apex Group, a global financial services provider, aimed to expand its footprint in asset management services. This transaction signals a consolidation trend within the financial services industry, with firms restructuring to stay competitive in the evolving online banking market.

-In February 2024, Sygnum Bank, Hamilton Lane, and Apex Group expanded access to private markets through DLT-registered shares in a USD 3.8 billion fund. This collaboration leverages blockchain technology to facilitate more efficient and secure transactions, further contributing to the evolution of online banking services and highlighting the role of emerging technologies in the financial sector.

Access Complete Report: https://www.snsinsider.com/reports/online-banking-market-1233

Table of Content:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Online Banking Market Segmentation, by Software

8. Online Banking Market Segmentation, by Service Type

9. Online Banking Market Segmentation, by Type

10. Online Banking Market Segmentation, by Banking Type

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release