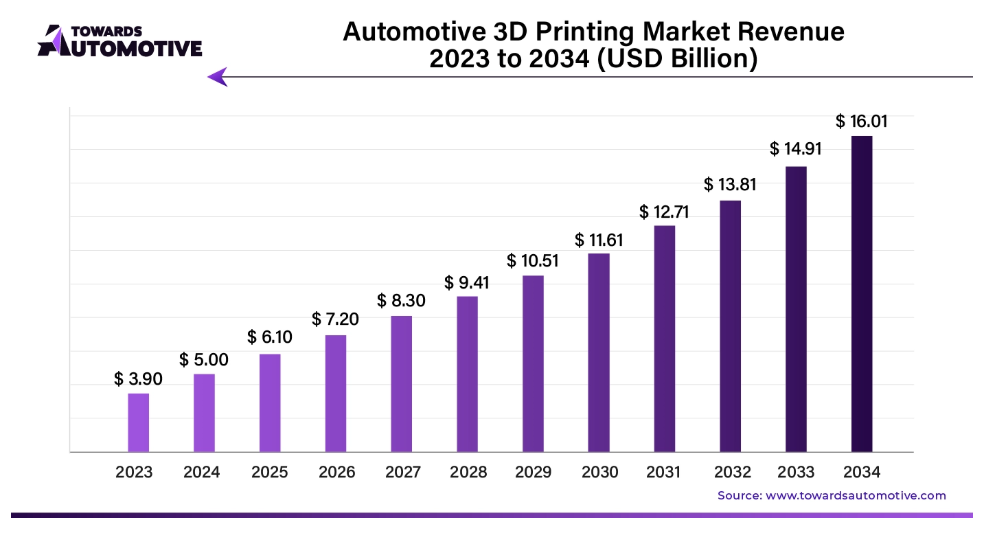

Automotive 3D Printing Market Size to Lead USD 16.01 Bn by 2034

The global automotive 3d printing market size is calculated at USD 6.10 billion in 2025 and is expected to reach around USD 16.01 billion by 2034, growing at a CAGR of 19.40% from 2025 to 2034.

/EIN News/ -- Ottawa, April 08, 2025 (GLOBE NEWSWIRE) -- The global automotive 3d printing market size was valued at USD 5.00 billion in 2024 and is predicted to hit around USD 16.01 billion by 2034, a study published by Towards Automotive a sister firm of Precedence Statistics.

Get All the Details in Our Solutions – Download Brochure: https://www.towardsautomotive.com/download-brochure/1002

Market Overview

The automotive 3D printing market is experiencing significant growth due to the rising adoption of additive manufacturing to enhance efficiency, customization, and cost-effectiveness. 3D printing technology is revolutionizing automotive fabrication by facilitating rapid prototyping, tooling, and even the manufacturing of end-use components. Car manufacturers are utilizing this technology to create lightweight, complex, and high-performance parts, which are particularly advantageous for electric and high-performance cars.

The capacity to generate intricate designs while minimizing material waste is accelerating widespread implementation among both OEMs and aftermarket suppliers. Additive manufacturing enables producers to fabricate parts that meet specific customer requirements. This feature is especially advantageous for luxury and high-performance automobiles, where consumers often look for distinctive qualities.

The incorporation of AI and machine learning is further refining 3D printing methods, enhancing design accuracy and speeding up production times. Moreover, developments in multi-material printing are enabling the production of strong and functional components, broadening the use of 3D printing from prototyping to full-scale manufacturing. The shift toward sustainable and on-demand production is also contributing to market growth, as 3D printing reduces material waste and energy usage.

Government programs supporting additive manufacturing and increased investments from major automotive companies are propelling market expansion. As automotive firms continue to explore new opportunities with 3D printing, the market is anticipated to grow swiftly, providing innovative manufacturing, customization, and supply chain efficiency solutions within the automotive industry.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Major Trends in the Automotive 3D Printing Market

- Growth of Metal 3D Printing for Final Parts: Automotive producers are adopting metal 3D printing to create lightweight and robust components. Techniques such as direct metal laser sintering and electron beam melting make it possible to fabricate complex metal parts, enhancing vehicle performance and efficiency.

- Integration of AI and Automation: Integrating AI algorithms in 3D printing improves accuracy, minimizes mistakes, and optimizes material utilization. Automated systems are streamlining the additive manufacturing workflow, facilitating quicker prototyping and large-scale production while reducing the need for human involvement.

- Increase in Multi-Material Printing: Innovations in multi-material 3D printing allow for the creation of parts with different properties, such as both flexible and rigid areas within the same component. This trend is especially useful for manufacturing functional items such as interior panels, seals, and customized vehicle parts.

- Rising Use in Electric Vehicle Production: 3D printing significantly contributes to electric vehicle production by lowering vehicle weight and enhancing electric vehicle battery efficiency. Manufacturers are employing additive manufacturing to create lightweight parts, tailored battery enclosures, and aerodynamic structures to boost EV performance and range.

Limitations & Challenges in the Automotive 3D Printing Market

- High Initial Investment Requirements: Implementing 3D printing in the automotive field requires substantial investments in cutting-edge printers, materials, and software. Smaller and mid-sized manufacturers may struggle to manage these expenses, limiting widespread adoption.

- Limitations in Material and Quality Concerns: Despite advancements in 3D printing materials, there still exist limitations regarding strength, durability, and heat resistance, particularly for metal and composite components. Maintaining consistent quality and adhering to automotive industry standards continues to be a challenge.

-

Slow Production Rates for Mass Manufacturing: Although 3D printing excels in prototyping and low-volume production, it is generally slower than traditional manufacturing techniques like injection molding and CNC machining. Scaling 3D printing for mass production within the automotive sector presents a significant obstacle.

Get the latest insights on automotive industry segmentation with our Annual Membership: https://www.towardsautomotive.com/get-an-annual-membership

Demand for Customized Automotive Parts: Market’s Largest Potential

The rising demand for customized and on-demand production of spare parts creates immense opportunities in the automotive 3D printing market. Conventional supply chain methods necessitate substantial inventories and comprehensive logistics systems, which lead to high storage expenses and possible delays. Through 3D printing, manufacturers can create customized or discontinued spare parts as needed, decreasing reliance on centralized production sites.

The production of lightweight vehicles presents another substantial opportunity. As automakers pursue improved fuel efficiency and sustainability, components made from advanced polymers and composites that are 3D-printed can greatly improve vehicle performance while minimizing emissions. Additionally, the rising production of electric vehicles intensifies the need for innovative 3D-printed battery housing, cooling systems, and structural parts. With the expansion of the EV market, 3D printing will be pivotal in enhancing vehicle efficiency, sustainability, and design versatility, signifying a transformative change in automotive manufacturing.

Regional Analysis

What to Expect from North American Countries till 2030?

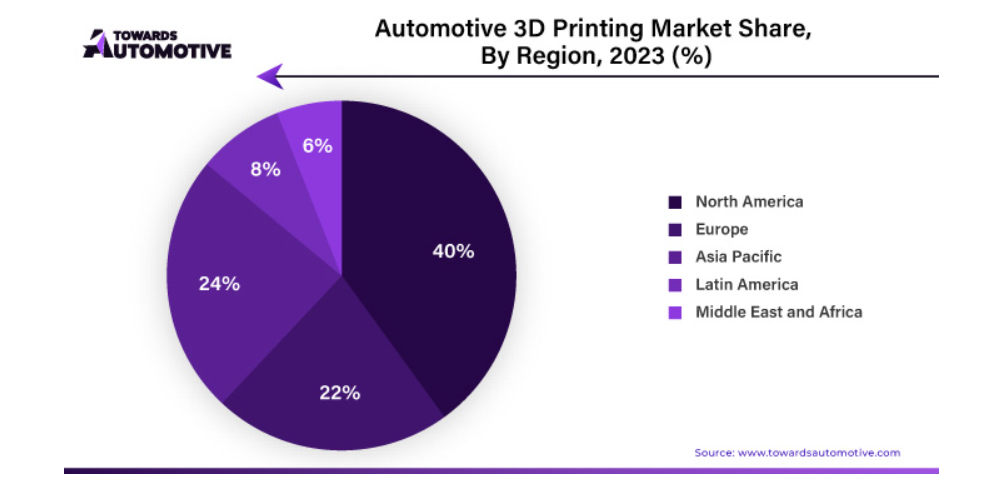

North America dominated the automotive 3D printing market with the largest share in 2024 due to its robust industrial foundation, technological innovations, and early adoption of additive manufacturing within the automotive industry. The presence of prominent automakers such as Ford, General Motors, and Tesla, as well as major 3D printing firms such as Stratasys and 3D Systems, has fostered a strong innovation ecosystem. The region's significant investment in research and development, paired with the rising demand for lightweight, fuel-efficient, and customized automotive parts, has further propelled market growth.

Governmental initiatives that support advanced manufacturing and sustainability have facilitated widespread adoption. North America’s intense focus on electric vehicles, autonomous driving, and digital manufacturing has established it as a leader in automotive 3D printing. The incorporation of artificial intelligence, the Internet of Things, and automation into additive manufacturing processes has improved production efficiency, lowering costs and reducing time-to-market for automotive parts.

Top North American Countries that have Stronghold on the Automotive 3D Printing Market

- United States: The U.S. stands as the largest market, propelled by major automakers such as Ford, General Motors, and Tesla, along with prominent 3D printing firms like Stratasys and 3D Systems. The country benefits from substantial R&D investments, government backing for advanced manufacturing, and a strong emphasis on electric vehicles and autonomous driving technologies.

- Canada: Canada is emerging as a significant contender in the automotive 3D printing sector, supported by government-funded projects and an expanding network of automotive R&D hubs. The nation is progressively adopting 3D printing for lightweight vehicle components and sustainable manufacturing practices, especially in the electric vehicle domain.

-

Mexico: Mexico is becoming prominent player in the automotive 3D printing market due to its robust automotive manufacturing sector, low production costs, and growing embrace of additive manufacturing technologies. Major global automotive firms operating in Mexico are utilizing 3D printing for prototyping, tooling, and small-scale production, enhancing the country’s presence in the market.

Asia Pacific to Boom Rapidly: Innovation in the Market to Support the Growth

Asia Pacific is expected to witness the fastest growth during the forecast period. This rapid growth can be attributed to increasing investments in cutting-edge manufacturing technologies, a surge in demand for electric and autonomous vehicles, and government initiatives that encourage industrial automation. Leading nations such as China, Japan, and South Korea are paving the way, with their strong automotive sectors incorporating 3D printing for tasks like prototyping, producing lightweight components, and enabling mass customization.

Elevate your automotive strategy with Towards Automotive. Enhance efficiency and drive better outcomes—schedule a call today: https://www.towardsautomotive.com/schedule-meeting

Major Factors for the Market’s Expansion in Asia Pacific:

- Asia Pacific includes some of the largest automobile manufacturers, such as those in China, Japan, and South Korea. The growing production of electric and autonomous vehicles is driving the adoption of 3D printing to optimize manufacturing processes and decrease expenses.

- Numerous governments in the region are supporting industrial automation and advanced manufacturing through funding and policy advantages. Initiatives like "Made in China 2025" and Japan's emphasis on smart manufacturing are speeding up the adoption of 3D printing in the automotive industry.

- The region is observing considerable investments in research and development focused on additive manufacturing. Companies and institutions are making advancements in material science, printing speed, and precision, which are increasing the feasibility of 3D printing for large-scale automotive endeavors.

The existence of major market players and research institutions driving innovation supports the automotive 3D printing market in the region. As the largest automotive market in the world, China is making substantial investments in 3D printing technologies to enhance production efficiency and minimize costs. Japan, recognized for its precision engineering in the automotive field, is utilizing additive manufacturing to improve production efficiency and cut waste. South Korea is integrating 3D printing into the development of next-generation vehicles, backed by its advanced technology sector.

Moreover, India and Southeast Asian countries are emerging as potential markets, benefiting from rising automotive production and government policies that favor digital manufacturing. As automotive manufacturers increasingly adopt 3D printing within their supply chains, Asia Pacific is set to lead the market, presenting significant opportunities for industry players aiming to expand their presence.

Segment Outlook

Offering Insights

The hardware segment dominated the automotive 3D printing market with the largest share in 2024. This segment encompasses 3D printers, print heads, and other essential components for additive manufacturing. The rising need for high-speed, precise, and cost-effective 3D printing machines has prompted adoption by automotive manufacturers and suppliers. The availability of sophisticated hardware compatible with diverse materials, combined with ongoing innovations from key players, has enhanced performance and reliability in the hardware segment. Additionally, the incorporation of IoT and AI into 3D printing hardware has boosted automation and efficiency, further cementing this segment's position at the forefront.

The service segment is expected to expand at a notable CAGR during the forecast period. This expansion is driven by an increasing demand for design, prototyping, consulting, and maintenance services provided by both OEMs and third-party suppliers. Many automotive companies are turning to service bureaus for their 3D printing needs to avoid the hefty initial costs associated with equipment and materials. Furthermore, as new users join the market, the dependence on expert services for customized solutions, design improvements, and part performance evaluations is projected to rise. The shift toward subscription-based service models is also contributing to long-term growth in this segment.

Type Insights

The stereolithography (SLA) segment led the automotive 3D printing market in 2024. SLA is widely utilized due to its capability to create exceptionally accurate and detailed prototypes with smooth finishes, making it suitable for both interior and functional part prototyping. It plays a crucial role in the early design and validation phases of automotive production. Automakers prefer SLA for its precision, swift turnaround, and versatility with materials. Furthermore, advancements in resin formulations and quicker curing techniques have enhanced the efficiency and scalability of stereolithography across various automotive applications, ensuring it retains its leading position.

The selective laser sintering (SLS) segment is projected to grow at the fastest rate during the projection period. This method involves using laser bim to fuse powdered materials, creating durable and intricate shapes without the need for support structures. Automotive firms are increasingly adopting SLS for the production of functional parts, jigs, and fixtures, particularly for under-the-hood and structural uses. The rising acceptance of SLS for both prototyping and small-batch production, along with the introduction of new high-performance materials, is significantly boosting its integration throughout the automotive manufacturing sector.

Material Insights

The polymers segment dominated the automotive 3D printing market in 2024. Lightweight, adaptable, and cost-efficient polymers are widely utilized for prototyping, fabricating interior components, and some under-the-hood applications. Materials such as ABS, PLA, and nylon lead the market due to their user-friendliness and compatibility with various 3D printing technologies. The increasing demand for polymer 3D printing is also driven by its capacity to produce intricate and custom shapes, thereby minimizing material waste and reducing tooling expenses. The automotive industry’s emphasis on weight reduction to enhance fuel efficiency has further accelerated the use of polymer-based 3D printed parts.

The metal 3D printing segment is likely to grow at a rapid pace in the coming years. Metals like aluminum, titanium, and stainless steel are becoming increasingly valued for crafting robust, durable, and heat-resistant automotive components. Applications span from engine parts and brake systems to custom structural elements in high-performance and luxury vehicles. As technology evolves, metal 3D printing is shifting from a focus on prototyping to the manufacturing of end-use parts. Progressions in powder bed fusion and directed energy deposition are making metal printing more cost-efficient and scalable, propelling its use for both performance improvements and mass customization.

Component Insights

The interior components segment dominated the automotive 3D printing market with the largest share in 2024. Car manufacturers are progressively employing 3D printing to produce dashboard components, control panels, air vents, and trim elements due to its design versatility and customization options. This method enables manufacturers to meet diverse customer preferences without incurring significant tooling expenses. The capacity to quickly create low-volume, intricate interior parts supports accelerated vehicle development cycles and fosters greater design innovation. As consumer demands for tailored interiors and premium finishes rise, 3D printing has become a favored approach for producing high-quality interior automotive elements.

The exterior components segment is expected to grow at a significant rate during the forecast period. The increasing demand for aerodynamic parts, body panels, bumpers, and grilles that can be rapidly prototyped or manufactured in small runs has driven the application of 3D printing in this area. Advanced materials, including reinforced polymers and metal composites, facilitate the creation of durable and weather-resistant exterior components. Additionally, advancements in 3D printing capabilities into large-format production have unlocked new possibilities for full-scale exterior parts, accelerating their adoption in concept vehicles and specialized productions.

Application Insights

The prototyping segment dominated the market in 2024. This is mainly due to the rise in the demand for rapid prototyping to accelerate production cycles. Additive manufacturing facilitates quick design iteration and testing of vehicle components prior to final production. This approach significantly lowers lead times and development expenses, enabling manufacturers to expedite market launches. Automotive research and development teams utilize 3D printing for assessing form, fit, and function, leading to enhanced design validation and performance evaluation. As the automotive industry remains committed to innovation and efficiency in product development, prototyping through 3D printing is a fundamental application of additive manufacturing worldwide.

The production segment is anticipated to expand at a notable CAGR during the forecast period. This trend is fueled by the rising adoption of additive manufacturing for producing low-volume, tailored, and high-performance automotive components. As 3D printing technologies become more economically viable and materials advance, manufacturers are tapping into its capabilities for creating end-use parts, especially for electric vehicles, motorsports, and luxury automobiles. The capacity to manufacture intricate components without traditional tooling minimizes waste, accelerates production timelines, and enables real-time adjustments in manufacturing. This evolution transforms conventional automotive production methodologies and accelerates this segment's growth.

Recent Breakthroughs in the Global Automotive 3D Printing Market:

- In March 2024, Stratasys Ltd. acquired the technology portfolio and intellectual property from Arevo, Inc., a Silicon Valley-based firm that specializes in direct digital additive manufacturing with composite materials. This acquisition encompasses key patents related to carbon fiber printing, enhancements in Z-strength, AI-driven in-situ build monitoring, and hardware design. By incorporating this technology into Stratasys' FDM printing systems, the company aims to broaden its manufacturing capabilities and deliver parts with superior performance, more dependable builds, and improved system efficiency.

- In March 2024, EOS GmbH introduced the EOS M 290 1kW, a new Laser Powder Bed Fusion (LPBF) metal additive manufacturing platform aimed at serial production. The EOS M 290 1kW is suitable for a variety of industries, including automotive, and provides a wide array of validated materials and processes. This platform is designed to enhance design versatility, reduce weight, and improve cost-effectiveness in metal additive manufacturing.

Browse More Insights of Towards Automotive:

- 3D Printing in Aerospace and Defense Market: https://www.towardsautomotive.com/insights/3d-printing-in-aerospace-and-defense-market-sizing

- Automotive 3D Map System Market: https://www.towardsautomotive.com/insights/automotive-3d-map-system-market-sizing

- Automotive Disc Brake Market: https://www.towardsautomotive.com/insights/automotive-disc-brake-market-sizing

- Autonomous Ships Market: https://www.towardsautomotive.com/insights/autonomous-ships-market-sizing

- Marine Port Services Market: https://www.towardsautomotive.com/insights/marine-port-services-market-sizing

- Motorsport Market: https://www.towardsautomotive.com/insights/motorsport-market-sizing

- HD Maps for Autonomous Vehicles Market: https://www.towardsautomotive.com/insights/hd-maps-for-autonomous-vehicles-market-sizing

- Polyurethane-Based Foams in Automotive Market: https://www.towardsautomotive.com/insights/polyurethane-based-foams-in-automotive-market-sizing

- PP Compound Automotive Market: https://www.towardsautomotive.com/insights/pp-compound-for-automotive-market-sizing

- Used Cars Market: https://www.towardsautomotive.com/insights/used-cars-market-sizing

Segments Covered in the Report

By Offering

- Hardware

- Extrusion System

- Motion System

- Build Platform Environs

- Control And Monitoring System

- Software

- Design Software

- Inspection Software

- Printer Software

- Scanning Software

- Services

By Type

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Fused Deposition Modeling (FDM)

- Electron Beam Melting (EBM)

- Digital Light Processing (DLP)

- Others

By Material

- Metal

- Polymer

- Ceramic

By Component

- Interior Component

- Exterior Component

By Application

- Prototyping

- Tooling

- Production

- Others

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1002

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release