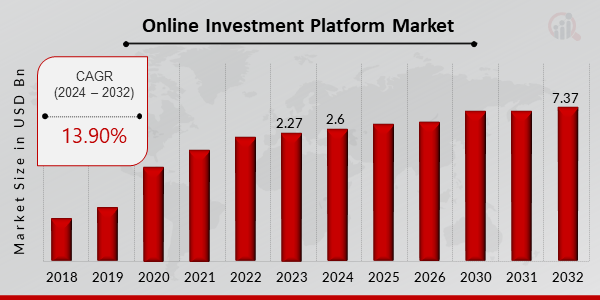

Online Investment Platform Market Projected for 13.90% CAGR, Reaching 7.37 Billion by 2032

Online Investment Platform Market Growth

Online Investment Platform Market Research Report By, Investment Type, Account Type, Investment Goal, Fee Structure, Technology Features, Regional.

SD, UNITED STATES, April 22, 2025 /EINPresswire.com/ -- The global Online Investment Platform market has witnessed remarkable growth in recent years and is poised to expand further in the coming decade. In 2023, the market size was valued at USD 2.27 billion and is projected to grow from USD 2.6 billion in 2024 to an impressive USD 7.37 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 13.90% during the forecast period (2024–2032). The growth is primarily driven by increasing digitalization of financial services, rising adoption of robo-advisors, and the growing interest of retail investors in capital markets.

Key Drivers Of Market Growth

Increasing Digitalization of Financial Services

With the proliferation of internet access and smartphones, investors are shifting towards digital platforms for seamless, real-time trading and portfolio management. Online investment platforms provide user-friendly interfaces, low transaction costs, and automated tools that are driving their widespread adoption.

Rising Adoption of Robo-Advisors

The integration of robo-advisory services is revolutionizing investment strategies by offering algorithm-based financial planning. These tools provide personalized investment recommendations, automate portfolio rebalancing, and reduce the need for human advisors—making investing more accessible and cost-efficient.

Growing Interest of Retail Investors in Capital Markets

Retail participation in stock markets has surged globally, particularly post-pandemic. Online platforms have democratized access to investment products, enabling individual investors to trade stocks, ETFs, and mutual funds with ease and transparency.

Advancements in AI and Data Analytics

Artificial intelligence and data analytics are enabling platforms to deliver predictive insights, customer behavior analysis, and risk profiling. These technologies enhance user experience, improve investment decisions, and boost platform efficiency—fueling further market growth.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24433

Key Companies in the Online Investment Platform Market Include

• Fidelity

• Charles Schwab

• Merrill Lynch

• Raymond James

• TD Ameritrade

• Morgan Stanley

• Citigroup

• UBS

• Goldman Sach

• S. Bancorp

• P. Morgan

• ETrade

• Wells Fargo Advisors

• Vanguard

• Bank of Americ

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/online-investment-platform-market-24433

Market Segmentation

To provide a comprehensive analysis, the Online Investment Platform market is segmented based on deployment model, investor type, end user, and region.

1. By Deployment Model

• Cloud-Based: Offers scalability, cost-efficiency, and remote accessibility.

• On-Premise: Preferred by institutions with in-house infrastructure and data security concerns.

2. By Investor Type

• Retail Investors: Increasing engagement through mobile-first platforms and educational tools.

• Institutional Investors: Use advanced platforms for high-frequency trading and portfolio management.

3. By End User

• Banks and Financial Institutions: Offering white-labeled investment solutions to clients.

• Investment Firms: Managing portfolios and advising clients via integrated digital platforms.

• Fintech Companies: Disrupting the market with innovative, AI-driven investment tools.

4. By Region

• North America: Leading market due to high fintech penetration and active investor base.

• Europe: Growth driven by increasing digital transformation and supportive regulations.

• Asia-Pacific: Fastest-growing region, fueled by rising financial literacy and mobile usage.

• Rest of the World (RoW): Moderate growth expected in Latin America, the Middle East, and Africa as digital finance infrastructure evolves.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24433

The global Online Investment Platform market is on a trajectory of substantial growth, driven by digital innovation, rising retail participation, and advancements in financial technologies. As investors continue to demand convenience, transparency, and real-time insights, the adoption of online investment platforms is expected to accelerate. With expanding use cases across different investor types and regions, the market is set to redefine how financial investments are made globally.

Related Report:

Electronic Gadget Insurance Market

Embedded Insurance Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release